unrealized capital gains tax bill

Introduced in House 11022021 Prohibiting Unrealized Capital Gains Taxation Act. Again under Bidens plan they would be required to pay a minimum 20 income tax on this appreciation.

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

Of all the many revenue-raising ideas that have bubbled up out of Washington the recent proposal to tax unrealized capital gains is particularly jarring.

. Be it enacted by the Senate and House of Representatives of the United States of America in. Democrats need to rethink their plan to tax billionaires on their unrealized capital gains which will discourage investment in the US. The Secretary of the Treasury including any delegate of the Secretary or any other Federal Government official shall not require or impose the implementation of taxation.

This bill prohibits the Department of the Treasury or any other federal. When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum. A lot of lies being spread about the proposed unrealized capital.

An unrealized gain is an increase in your investments value that you have not captured by selling the investment. The Problems With an Unrealized Capital Gains Tax. Even though reports suggest the proposed.

Below are one economists estimates of what the top 10 wealthiest. Unrealized capital gains tax means if you buy a stock for 100 and it goes up to 500 then back down to 50 you owe taxes on the 400 profit you never made. Democratic leadership over the weekend began suggesting a new way to pay for President Bidens multitrillion-dollar social policy and climate action spending bill a tax on.

5814 is a bill in the United States Congress. Unrealized gains are not taxed until you sell the investment. The amount youll pay in capital gains taxes depends primarily on how long you held an asset.

To increase their effective tax rate. Mitt Romney R-Utah told. Text for HR5814 - 117th Congress 2021-2022.

The Democrats have stressed that taxes will not be increased on middle- and working-class Americans. The tax will charge a long-term cap gains rates on all unrealized monies for tradeable investments which includes stocks bonds. A bill must be passed by both the House and Senate in identical form and then be signed by the President to become law.

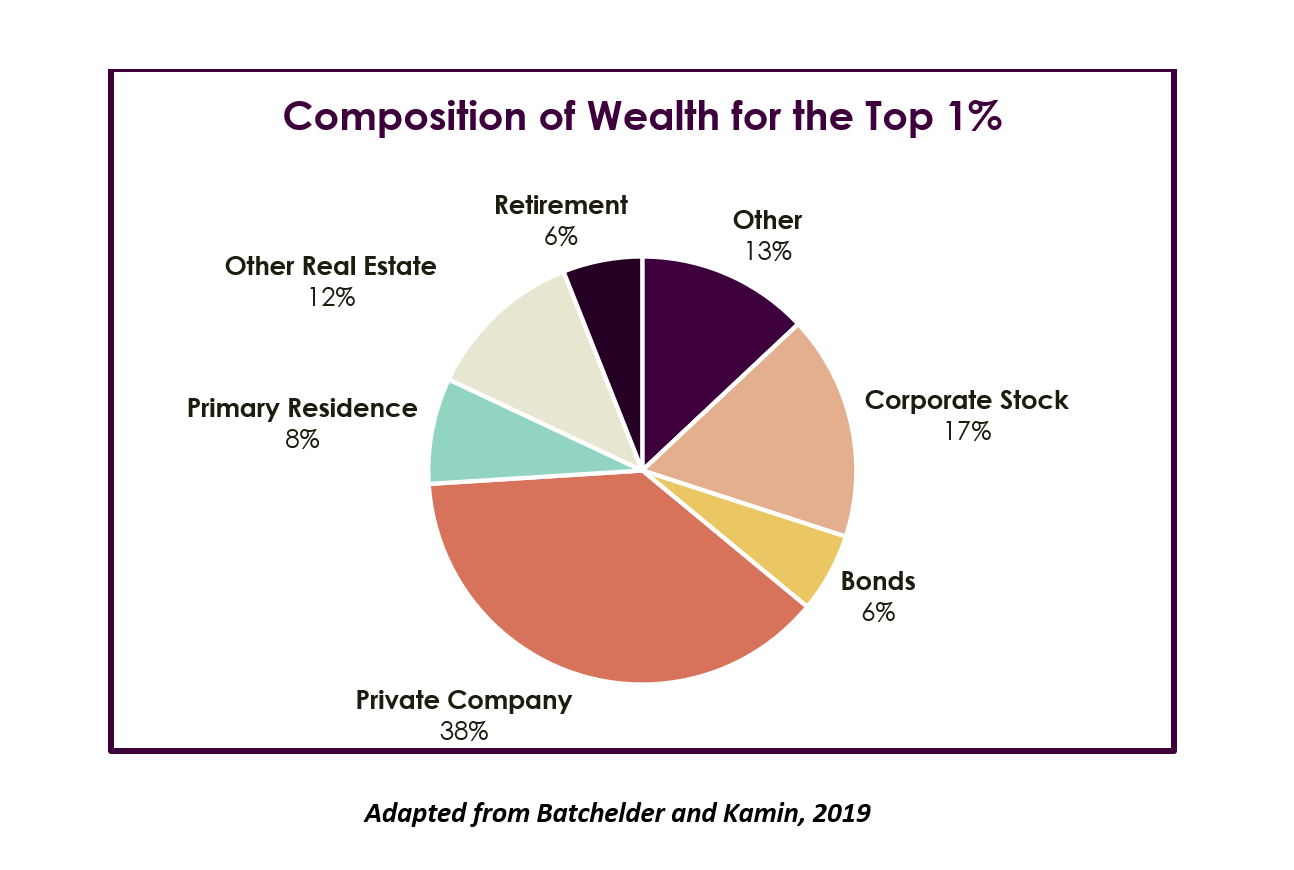

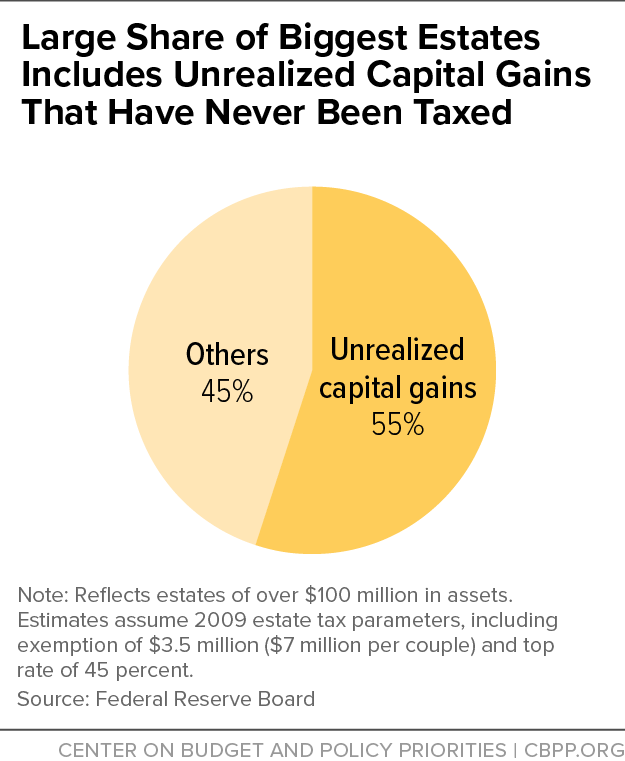

The largest part of the tax bill will be upfront. Now that weve looked at what a tax on unrealized capital gains could be like its time to point out three significant. Unrealized capital gains Almost all households 98 in the top 10 have some sort of unrealized gains according to most recent Federal Reserve data from 2019.

Under the proposed Billionaire Minimum Income Tax households with a cumulative annual income over 100 million could face a sizable 20 tax bill that includes the. We probably will have a wealth. Prohibiting Unrealized Capital Gains Taxation Act.

Introduced in House 11022021 Prohibiting Unrealized Capital Gains Taxation Act. If you hold an asset for less than one year and sell for a capital gain the. A BILL To prohibit the implementation of unrealized capital gains taxation.

This bill prohibits the Department of the Treasury or any other federal. The taxation on unrealized capital gains is expected to affect people with 1 billion in assets or 100 million in income for three consecutive years.

Democrats Look To Billionaire Tax On Unrealized Capital Gains Fortune

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Share The Wealth Washington Economic Opportunity Institute Economic Opportunity Institute

Manchin Pans Biden S Proposed Tax On Unrealized Gains Of Wealthy Bloomberg

High Class Problem Large Realized Capital Gains Montag Wealth

Capital Gains Tax What Is It When Do You Pay It

Ending Special Tax Treatment For The Very Wealthy Center For American Progress

Capital Gains Tax Hike And More May Come Just After Labor Day

Deferring Capital Gains Potential Benefits Russell Investments

How Tax Loss Harvesting Can Reduce Your Tax Bill Personal Capital

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Proposed Tax On Billionaires Raises Question What S Income The New York Times

Unrealized Capital Gains Tax For Billionaires Explained

Ending Special Tax Treatment For The Very Wealthy Center For American Progress

Dems Plan Billionaires Unrealized Gains Tax To Help Fund 2t Bill

Capital Gains Are Sensitive To Taxation Jct Report Tax Foundation